Freddie mac loan limits for 2017 full#

VMG offers a full array of commercial and residential appraisal products and services. Valuation Management Group is a national, residential and commercial appraisal management services company that manages the appraisal process, including the appraisal review, for financial institutions, banks, mortgage bankers, and credit unions.

Freddie mac loan limits for 2017 free#

If there are any additional questions about this announcement, please feel free to reach out to Sharon Lynn, Vice President of Client Relations. Valuation Management Group, as part of our appraisal management. Freddie Mac accepts the submitted value estimate as the value of the subject property. Valuation Management Group is pleased to share this long awaited news with our partners. Posts Tagged: Freddie Mac FHFA Announces Maximum Conforming Loan Limits for Fannie Mae and Freddie Mac in 2017 Posted December 6th, 2017 by Keith Morgan & filed under Blog. Deleted May 2017 Loan is eligible for collateral representation and warranty relief with an appraisal waiver until ACE expiration date. To read Fannie Mae Lender Letter LL-2016-05 and Freddie Mac’s Announcement in their entirety, please use the following links: The California Conforming Loan limit in 2017 was 424,100 and in some. For current limits, see link in Resources.

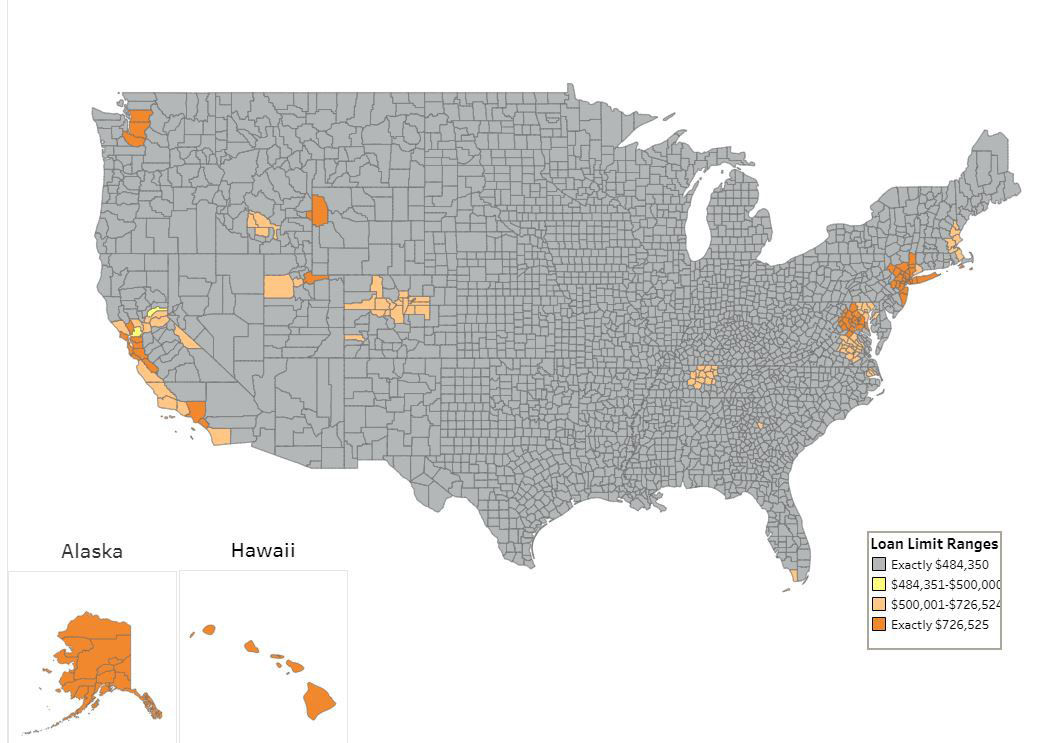

Properties in areas defined as high cost are associated with higher loan limits. Loan limits vary by number of units and by property location. In late 2018, the Federal Housing Finance Agency (FHFA). Agency (FHFA) publishes Freddie Mac’s conforming loan limits annually. Plus, using a Freddie Mac Multifamily Small Balance Loan means you are building a track-record with a funding source that doesn’t geographically limit your growth. Furthermore, FHA home loan limits are influenced by the limits set by Fannie Mae and Freddie Mac. The new loan limits are effective for loans delivered on or after January 1, 2017. The Fannie Mae and Freddie Mac baseline Conforming loan limit in California is now. Freddie Mac Multifamily Small Balance Loans, however, give you much more room to grow because they are not subject to the same local limits. You can access the high-cost area loan limits for 2017 via this link: Virgin Islands will increase to $636,150 In other high-cost counties, higher loan limits will apply. The conforming loan limit for one unit homes in in Alaska, Guam, Hawaii and the U.S. On November 23, 2016, the Federal Housing Finance Agency (FHFA) announced that the maximum base conforming loan limits will increase for the first time since the housing crisis that began in 2006.įor most of the country conforming loan limits for one unit homes will increase from $417,000 to $424,100. Valuation Management Group, as part of our appraisal management services, strives to keep our partners updated on industry related issues. (Mortgages are often sold to Fannie or Freddie so that a lender has the liquidity/money available The post Conforming Loan Limits. A mortgage loan is considered conforming when it is eligible to be acquired by Fannie Mae and/or Freddie Mac. To read Fannie Mae Lender Letter LL-2017-10, access Fannie Mae’s Loan Limit Look-Up Table 2018 and read Freddie Mac’s Announcement in their entirety, please use the following links. The Selling System was updated on December 2, 2016. The new loan limits are effective for loans delivered on or after Janueven if originated prior to January 1, 2018. Posted December 1st, 2016 Filed under Blog. The Federal Housing Finance Agency has announced that it is increasing the maximum conforming loan limits for mortgage loans beginning in 2017. However, Mortgages meeting the 2017 limits are not eligible for sale to Freddie Mac until on or after January 1, 2017. f1938: Created Fannie Mae as a government agency Purchased FHA-insured loans to provide liquidity for mortgage lenders 6 During the Great Depression, the. FHFA Announces Maximum Conforming Loan Limits for Fannie Mae and Freddie Mac in 2017

0 kommentar(er)

0 kommentar(er)